Total debt recall

One of the more interesting figures that I came across was that in 2000, every $2.4 of debt creation produced $1 of GDP growth. Today that figure is up to $4.6 for every $1 of GDP growth. In other words, the impact of debt creation is having less and less of an impact on real economic growth. Unless you live in the digital cloud, you care about the real economy.

Ultimately the health of an economy should be measured by good paying jobs and income growth. Since the recession ended in 2009 we have seen more growth in low wage jobs and income growth is not to be found. At the same time, the Fed has expanded its balance sheet to a whopping $4 trillion.

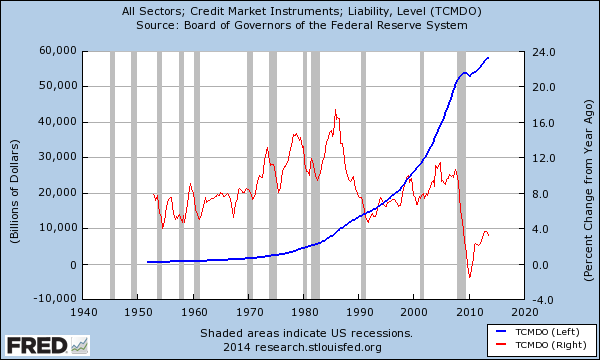

Total debt is also growing in our own system at home:

Source: Federal Reserve

The total US debt market is close to $60 trillion. So the US alone is a big chunk of the $230 trillion in total global debt outstanding. Central banks at this point are stuck in a rut. For large economies like the US and Japan having interest rates rise is simply unacceptable given the massive amount of debt carried by these countries. This of course assumes that central banks have full power over the economy.

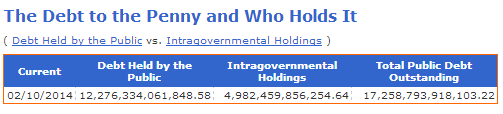

Take for example the US public debt:

Source: US Treasury

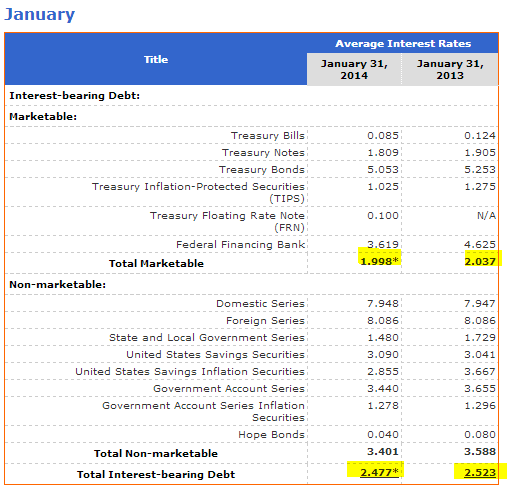

The US currently owes $17.25 trillion. What is important to note is that the US is borrowing at a ridiculously low interest rate:

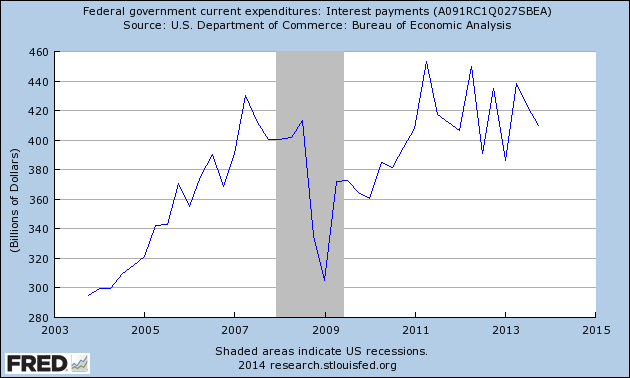

For total marketable debt, the average interest rate is 1.998 percent and for non-marketable debt it is 3.401 percent. Blended the average rate is 2.477 percent. Even at this historically low level our interest payments are well above $400 billion per year:

Even if rates went up to historically low levels of say 5 percent, this would bring annual debt servicing to close to $1 trillion. To put this in perspective the government collects about $2.9 trillion so that $1 trillion is no small amount in relationship to what is being generated on the tax side.

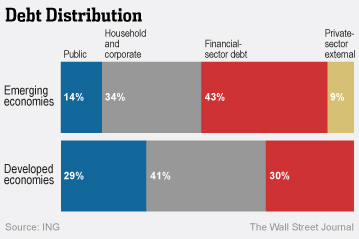

The US is no exception here. We recently started seeing a mad dash to the exits in developing countries. Why? Interest rates are higher for an emerging economy for obvious reasons:

Very little is financed by the private-sector in developed countries as would be expected. As financial markets develop these things can change but given the low rate environment, people have chased yields all across the globe. Hence a total of $230 trillion and more in public, private, and corporate liabilities. Yet what we are seeing is a large amount of rent seeking and more debt being needed to generate $1 of GDP.

There is such a thing as too much debt. Short of incomes rising we are merely setting up a different sort of debt crisis. We already got a bit of a taste of that early in the year in many emerging markets.

Source: http://www.mybudget360.com/global-debt-total-amount-of-debt-world-gdp-to-debt-ratios/

No comments:

Post a Comment